Below is the ‘Descending Triangle,’ in which price has respected a horizontal support level while offering a down-ward sloping trend-line. Related is the ascending triangle that is highlighted with an https://g-markets.net/ upward sloping trend-line. Volume can help when confirming a spring; however, the focus of this article is to explore price action trading strategies, so we will zone in on the candlesticks alone.

- It’s important to note that price action trading requires a deep understanding of market dynamics, chart patterns, and candlestick formations.

- Flat markets are the ones where you can lose the most money as well.

- After all, it’s just a combination of the two terms, “price action” and “trading strategies”.

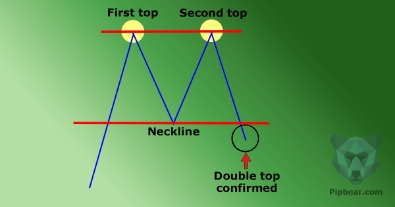

- In this case, that is the distance between the neckline and the peak.

- We talk about this A LOT because of all the aforementioned reasons, and quite simply – it works.

- Since price action trading doesn´t predict the future like many other indicators, it never lies; it will tell you how the market will behave during different time frames and periods of volatility.

Any signal on the trading chart that indicates the emergence of a trend is known as a price action indicator. Experienced traders can use these indicators to make profitable trades on the market in real-time. In the case of a downtrend, when the opposing candle is bigger than the previous one, the pattern is called a bullish engulfing pattern.

Price action strategy: a complete guide for traders

Price action trading strategies revolve around repeatable patterns that occur on the market. Here are some of the most popular price action patterns and tips on identifying and trading them. To achieve success in forex trading, consider exploring price action trading. This powerful method can give you a distinct advantage by uncovering the secrets hidden within price movements.

Silver Forecast: Continues to See Noisy Behavior – DailyForex.com

Silver Forecast: Continues to See Noisy Behavior.

Posted: Thu, 10 Aug 2023 07:00:00 GMT [source]

My goal as a trading mentor is to lay a simple path for all traders to follow, that path is paved with the price action strategies that I have found to be very effective over the years. Be sure to check out Part 6 of the course on price action analysis for a refresher on what price action trading is all about. The next step in trading price action forex is to look for price action patterns. Price action patterns are formed by the continuous buying and selling of currencies by traders and investors. These patterns can indicate a potential reversal or continuation of the trend. There are different price action patterns such as pin bars, engulfing bars, and inside bars.

A Bearish Engulfing Pattern before a massive move lower

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money. We want to clarify that IG International does not have an official Line account at this time. We have not established any official presence on Line messaging platform.

You can make two trades out of this pattern; either enter immediately as the narrow range breakout occurs and/or enter again when the price reverses back to test the range. Yet, when a trend has run its course, one of the signs that a reversal is imminent is a big opposing candle. Quite often at the end of a trend, we see a big candle take place in the direction how to trade price action in forex of the trend followed by an opposing candle of similar size. It means that the bears in a downtrend have had a last go at a level, pushing the price further. In response, the bulls jump right back in and take price to the level where the previous candle opened. In this case, the sellers added more shorts or took profit on the ones that were already open.

Method 2: Grade Trends by Focusing on Swings

I’ve covered price action in other lessons, so I’m not going to belabor the topic too much. The basic idea behind price action is that we’re studying how the market moves relative to previous price movement. We can even rope in some additional Support and Resistance studies in an attempt to find really important levels. Psychological levels, for instance, can be a great way of pointing out swings that might have a little more importance in the market place.

EURUSD: Short Trade Of The Year? – Daily Price Action

EURUSD: Short Trade Of The Year?.

Posted: Thu, 10 Aug 2023 07:00:00 GMT [source]

On the chart below, we can see that the price easily broke above the top of the last swing which was made of only two candles. We can also see that on the second occasion, where the top is made of several candles, the forex price action couldn’t break above it. There’s also a higher probability that your trade will be successful if there are a few candles at the top of the last swing. However, if there are many candles at the top it means that the resistance is very strong because it tried many times to break above that level but failed. Therefore, it is safer to enter when there are fewer candles at the top. To effectively interpret price action in forex trading, follow these steps.

The Role of a Forex News Calendar in Risk Management Strategies

While we have covered 6 common patterns in the market, take a look at your previous trades to see if you can identify tradeable patterns. The key thing for you is getting to a point where you can pinpoint one or two strategies. Inside bars occur when you have many candlesticks clumped together as the price action starts to coil into resistance or support. The candlesticks will fit inside of the high and low of a recent swing point as the dominant traders suppress the stock to accumulate more shares. Traders should also look for chart patterns to identify potential trade setups. These patterns can be used to enter and exit trades and to place stop-loss orders.

Before we get into the individual elements of price action, there are a few important points to establish. Secondly, you have no one else to blame for getting caught in a trap. Don’t bother emailing the guru with the proprietary trade signal that had you on the wrong side of the market.

Trend lines are diagonal lines that connect two or more price points on a chart. Traders use trend lines to identify the direction of the trend and to enter and exit trades. After you’ve removed all the indicators and other unnecessary variables from your charts, you can begin drawing in the key chart levels and looking for price action setups to trade from. Discover the top 5 stock market trading strategies that can help you make informed investment decisions.

But after that – traders can focus on getting the probabilities on their side as much as possible through analysis, and this is where price action can really shine. If you have been day trading with price action and volume – two of our favorite tools – then the money flow index (MFI) indicator would not feel alien to you. Notice how the price barely peaked below the key pivot point and then rallied back above the resistance level.

The Popularity of Price Action Trading

Traders can use these levels in conjunction with price action patterns to determine potential entry or exit points. Price action in forex trading involves analyzing the historical price movements of a currency pair without relying on lagging indicators. Traders who utilize price action focus on studying the patterns, formations, and behavior of price on their charts to identify potential trading opportunities.